The OS for Private Capital Markets

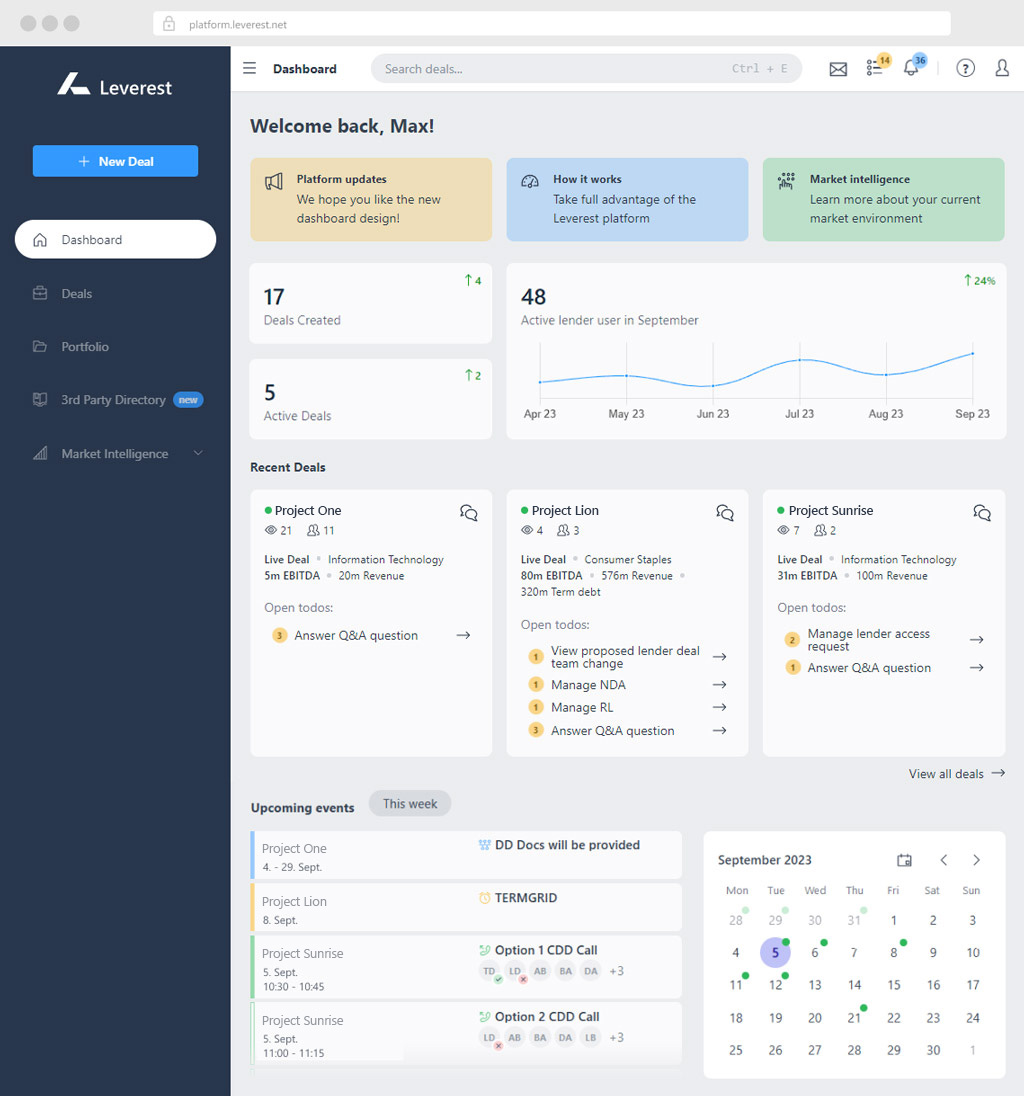

Close Deals faster, smarter and more efficiently

Leverest streamlines financing workflows for leading Private Equity Investors, Companies, Investment Banks and Lenders – from pre-deal and execution to portfolio management.

Trusted by

Powering Private Market Transactions

Simplify every phase of the private capital deal lifecycle with intelligent tools — enabling faster, more efficient, and secure deal execution.

Unmatched Market Access

Access a curated network of top-tier lenders and trusted third parties — connecting you to the right capital and expertise when it matters most.

Data- & Relationship Insights

Unlock the full value of your firm’s data and relationships, surface insights and drive smarter decisions — all while reducing transaction cost & time.

Full deal cycle platform

1. Pre Deal

Data & Relationship Intelligence

- Lender Intelligence: Database of >1000 lenders

- (Lender/Investor) Relationship Management

- Data Analytics

- CRM empowerment (APIs to other CRMs eg DealCloud, Salesforce)

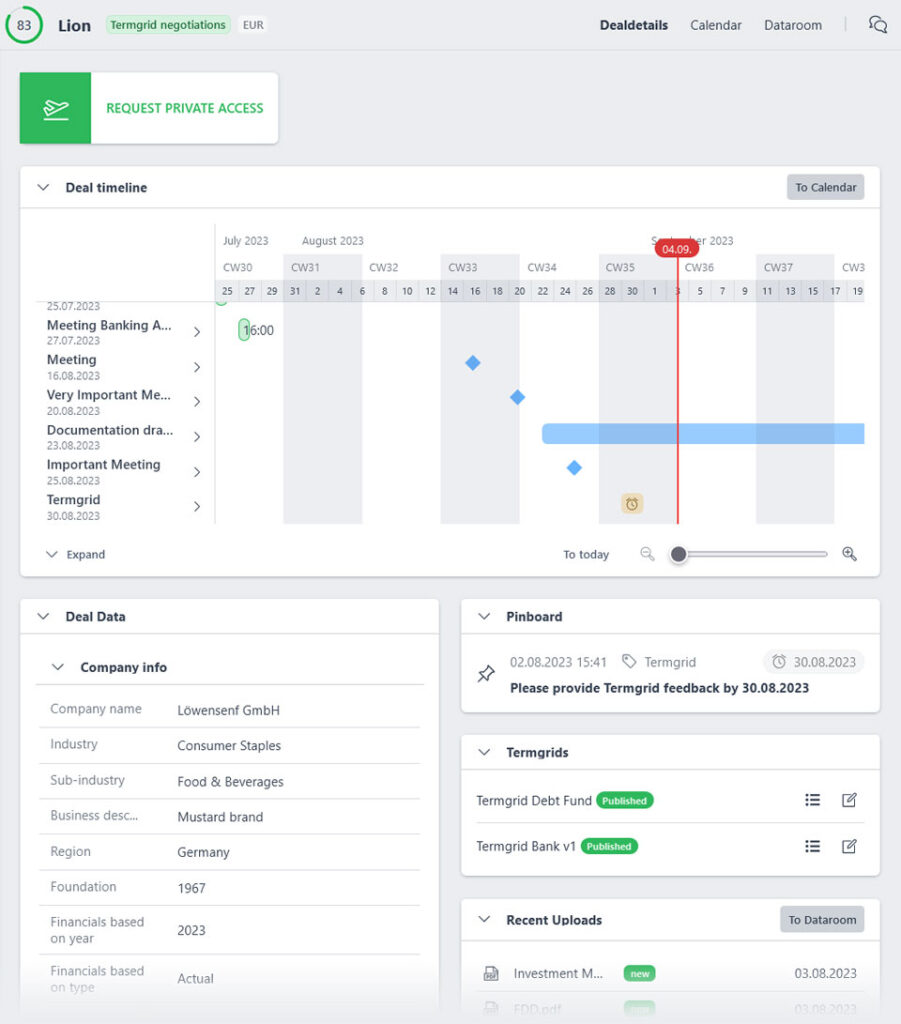

2. Deal Execution

Workflow Software

Marketplace

- Connection to >1000 lenders

- Easily search & discover our network of external service providers.

- AI-assisted matching algorithm connecting borrowers with the most suitable lenders — and lenders with the most relevant investment opportunities.

Workflow Tools

- Deal & Lender Management

- Q&A Management

- Data Room

- Digital Termgrid Negotiation

3. Post Deal

Portfolio Management

- KPI, covenant & capital structure monitoring

- Collaborative interface for Port-Cos/Finance teams

- Loan servicing & APIs to agencies (eg GLAS)

- Interface showing Fund and PortCo Level overview

Trusted by leading clients

The Leverest platform streamlines our financing processes by eliminating manual, non-value-added tasks while delivering real-time insights into financing status for deal team members. The Leverest team is deeply committed to innovation, consistently implementing improvements at an impressive pace.

The Leverest platform streamlines our financing processes by eliminating manual, non-value-added tasks while delivering real-time insights into financing status for deal team members. The Leverest team is deeply committed to innovation, consistently implementing improvements at an impressive pace.

We see Leverest as a software tool that allows us to handle more mandates with the same number of employees without compromising the quality of the advice we provide.

We see Leverest as a software tool that allows us to handle more mandates with the same number of employees without compromising the quality of the advice we provide.

We are delighted and proud to partner up with Leverest and have access to their bespoke and market leading tools and their immense data base!

We are delighted and proud to partner up with Leverest and have access to their bespoke and market leading tools and their immense data base!

We provide the highest standard

Seamless Integrations

Effortlessly connect with your existing workflows, CMS, and tools

Enterprise-Grade Security

We follow rigorous security standards and undergo regular independent penetration testing

Priority Support

Our team of industry experts is always ready to help you resolve issues quickly and effectively

Mobile App

Securly access the full power of our platform anytime, anywhere - directly from your mobile device

ISO 27001 Certified

Certified for information security management, ensuring operational excellence and compliance (SOC2-equivalent)

Data Privacy by Design

Fully GDPR compliant and following U.S. standards for secure data processing and storage

What are you waiting for?

Sign up now

Borrowers

(Private Equity Investors, Corporates, CFOs)

Sign up to our platform to manage your confidential financing processes efficiently and receive proprietary information on the financing market.

Debt & M&A Advisors

Sign up to our platform to manage your customer's financing processes and take advantage of our efficient software solutions to upgrade the quality of your debt services.

Lenders

Sign up to our platform to receive financing opportunities that match your individual criteria. Manage your financing processes efficiently and receive proprietary information on the financing market.

Latest news

Leverest partners with Arctic Securities to expand access to Nordic bond financing

Frankfurt/Berlin, Germany – Leverest is thrilled to announce its cooperation with Arctic Securities, a leading Nordic investment bank with a strong international footprint. Through this partnership, Leverest users can now

The Leverest platform supports Renewable Energy Company and FSN Capital in the execution of the company’s growth financing

Frankfurt, Berlin – The Leverest platform supported Renewable Energy Company, an independent power producer headquartered in Denmark, in raising growth financing. Renewable Energy Company, headquartered in Aarhus (Denmark), was established

The Leverest platform supports Mediobanca, acting as debt advisor to EMZ Partners, on the financing of its investment in koenig.solutions (“KS”)

Frankfurt, Munich – The Leverest platform supported Mediobanca, acting as debt advisor to EMZ Partners, on the financing of its investment in koenig.solutions (KS), a leading SAP services provider for

The Leverest platform supports Borromin Capital on the refinancing of Protect Medical Holding GmbH

Los Angeles, London – The Leverest platform supported Borromin Capital on the refinancing of Protect Medical Holding GmbH (“PMH”), a leading European platform focused on the manufacture, trade, and distribution