Why leading Private Equity Investors work with us

Faster, smarter & more efficient deal making

Increase Equity Returns

Increase Equity Returns

- Best Financing Terms

- And Efficient Processes

- Drive Fund Returns

Enhanced Deal Making

Enhanced Deal Making

- Improved commercial Results (Debt Terms) through full Market Access

- Increased Transaction Security

- Enhance competitive Dynamics

Improved Working Lives

Improved Working Lives

- Enhanced Transparency & Collaboration

- Focus on what truly propels Progress

- Increase Productivity of Dealteam

1. Lender Intelligence

Access to Global Leverest Lender Database enriched with your personal CRM Data (e.g., NDAs, Debt Terms, Credit Documentation, etc.) for each Lender for effective Lender Engagements

Manage all Deal-related Debt Information in one convenient Place, always ensuring easy Access & efficient Monitoring

Stay ahead of everchanging Lender Requirements with our dynamic Tool, facilitating prompt & informed Decision Making

Access tailored Analyses & Statistics, empowering yourself with invaluable insights for strategic & successful Lenders Engagements

2. Leverest Marketplace

Full Market Spectrum: All Lenders Types, Ticket Sizes and Debt Structures:

- Banks, Debt Funds, Credit Opportunity Funds, Asset Based Lenders (etc.)

- Senior, Unitranche, Mezzanine, HoldCo PIK, RCF, Asset-based, Venture Debt (etc.)

- Debt Tickets range from €3m to €1bn+

Matching supported by proprietary “Relevance Score” Algorithm

Easily search & discover our network of external service providers. Via our curated 3rd Party Directory you can receive invaluable support & excellent analysis from proven experts. Keep your processes efficient by directly collaborating with them on your deal via the Leverest platform.

3. Workflow Management

- Tech-supported Longlist Creation & Lender Invitation per Click to kick-start Process

- Smart Algorithm scores entire Lender Database & ranks best suited Lenders matching your specific Deal Parameters

- Maintain full Control, Transparency & Oversight along every Process Step

- Smooth Handling of Workflows & direct Communication with Lenders via built-in Q&A & Deal Chat Tool

- File Sharing made simple. Structured Information made available to Lenders in one Place

- Automated Watermarking of Files

- Dataroom analytics showing lender-traction on deal

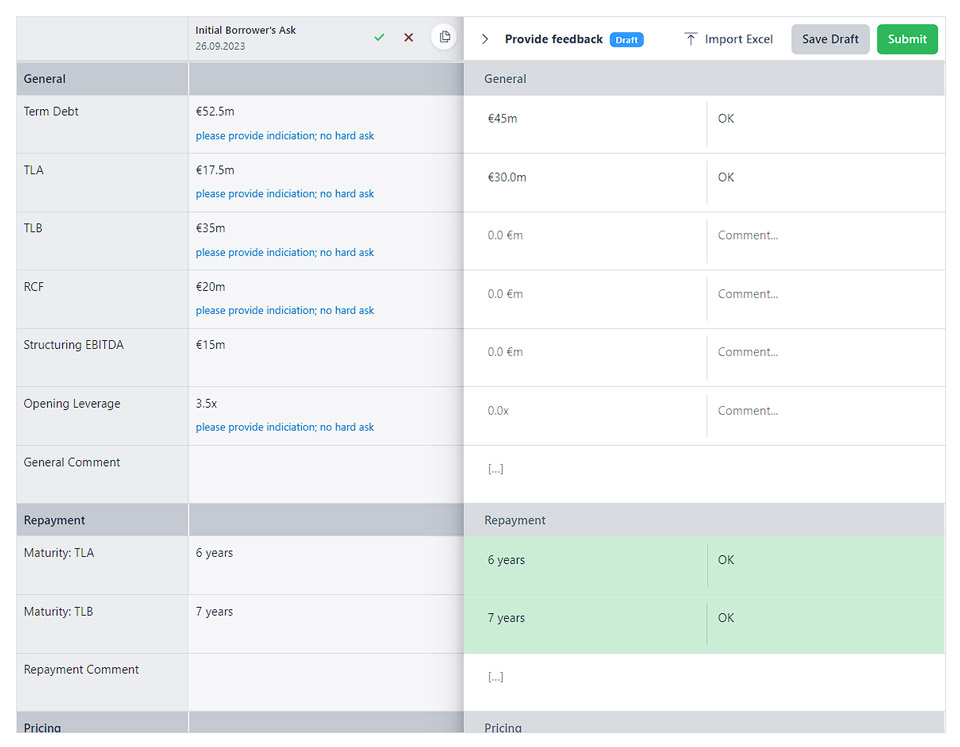

- Create customisable Termgrids, share them with Lenders & receive Terms with an Indication of Commitment Level

- Negotiate Terms via built-in Tool & iterate over several Rounds using mark-up Functionality

- Strong Basis for Long-form Documentation

4. Portfolio Management

Streamline the Credit Reporting Process with Leverest’s intuitive User Interface that makes it easy for Finance Teams to share Reports & maintain an Overview at all Times

Gain Insights into financial Covenants and the current Capital Structure, ensuring Transparency and proactive Management of key financial Metrics

- Enhance Collaboration & Productivity by effortlessly exchanging Documents through the connected Dataroom

- Experience a streamlined Workflow for Document sharing & retrieval

- Facilitate effective Lender Communication using the Pinboard & Chat Tools

- Enable your Finance Team to collaborate seamlessly, share Insights & make informed Decisions in Real-Time

- Take control of Reporting Deadlines from both the Loan Agreement & ad-hoc Requirements

- Empowers Finance Teams to stay ahead, ensuring timely Submissions & proactive Management of Reporting Obligations

We provide

Easy Access

Easy access to a large universe of potential lenders / potential deals

Confidentiality

Highest standards of confidentiality. Double-layer security at any time.

Insights

Superior insights into the debt financing market

TECH Support

Tech-supported process management through tailored software solutions.

Control & Transparency

Increased control and transparency in financing processes

Data Security

Military-standards on data security. Double-layer security at any time.