Introduction

In a (Leveraged) Debt Financing transaction, finding the right lender for the desired structure supporting the underlying (growth) strategy at the best possible terms & conditions is not an easy thing. The integrated platform Termgrid tool of Leverest can provide ideal support by offering highly flexible & tailored grid templates that help managing credit terms negotiation with numerous lenders. Leverest is a FinTech platform designed to help investors, debt advisors and corporates (“borrowers”) finance their deals in a fast, smart and efficient way applying modern technology.

What does the Termgrid Process typically look like and how is the Termgrid classified?

As already revealed by the term, (Leveraged) Debt Financing transactions occur using a significant amount of debt and involve a complex interplay of various financial variables. Debt is typically secured by a pledge on the shares and the assets of the borrower and is repaid using the cash flow from operations generated over time. Before such financings are signed and sealed, borrowers need to approach the capital market first. They establish contact to a selected number of suitable lenders whom they pitch their investment case to and share their structuring thoughts with. Lenders assess the underlying financing case based on the information shared by the borrower (the bundle of information provided is usually thinner in the beginning and more detailed as the process advances) and submit a Term Sheet (also referred to as “Termgrid”) in case of interest.

What you need to know about Termgrids (Basic) and the Challenges of the Offline World

The Termgrid itself typically summarises the main terms & conditions based on which a financing is deemed conceivable by a lender. In addition to the type, amount and ranking of the loans, it also comprises information on borrowers and guarantors, intended uses, the main disbursement conditions, the period of possible drawdowns, margins, maturities, repayments, early repayments, collateral, commitment fees, assurances, financial covenants, conditions, grounds for termination, costs, choice of law and place of jurisdiction. The credit terms & conditions contained in the Termgrid are, of course, not conclusive. Nevertheless, they are of considerable importance for the preparation of the subsequent credit agreement & security documentation, as these are drawn up on the basis of the Termgrid and should not deviate from it in any significant points.

When borrowers send the first draft of a Termgrid to various potential lenders, they tend to enclose very detailed Termgrids in order to specify their legal position (e.g. through the usage of LMA documentation language) in as many points as possible. The Termgrid is negotiated between lenders and borrowers and is attached to the commitment letter. In fact, Termgrid negotiations usually last several rounds as borrowers test the degree of flexibility among lenders to optimise their credit terms & conditions. In the offline world this means coordinating a chaotic back-and-forth of countless emails given the large number of lenders which makes it difficult to track the progress of negotiations. It becomes particularly critical when, for example, entire negotiation histories can no longer be traced due to sudden personnel loss/change – either during the transaction or after it has been completed. In either case, working through individual negotiation threads is often very costly and time-consuming. Here is where the Leverest platform comes into play.

What Benefits do you have using the Leverest Platform to manage your Termgrid Process?

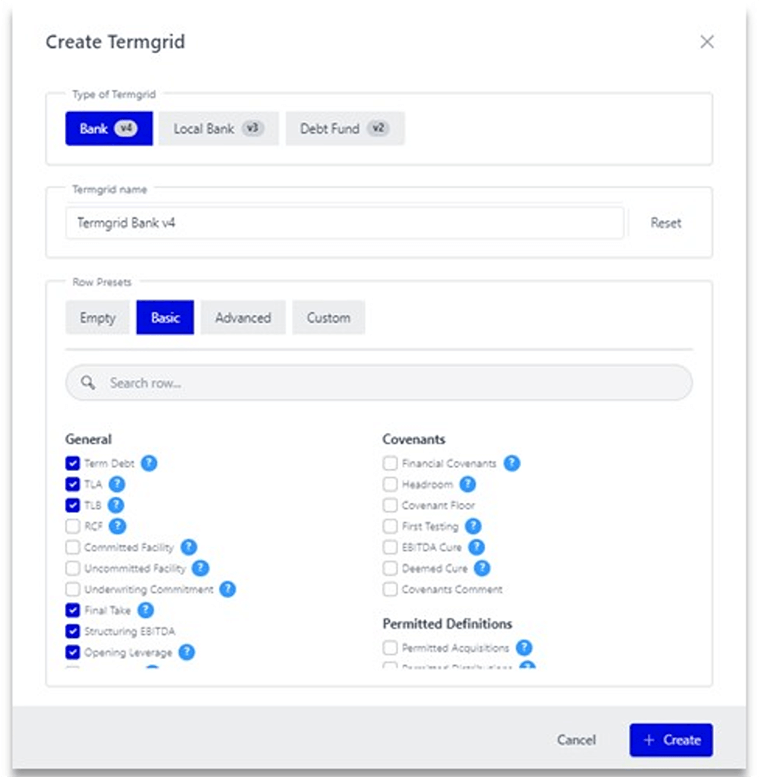

With the Termgrid feature, Leverest has designed an indispensable tool on its platform that is intuitive, flexible, and easy to manage. It comprises best-practices from the offline world and leverages upon the advancement of technology. Having a modular building block principle in place, it allows borrowers to create highly customised grids addressing different lender groups. By using free text fields, borrowers can specifically add parts of the documentation language in order to clarify legal positions at an early stage.

Borrowers can automatically share their own standard grids with individual lenders or entire groups of lenders via the Deal Cockpit with a single mouse click. The great advantage of the Leverest Termgrid feature is that, once shared with lenders, it allows for instant comparison and simplifies Termgrid negotiations due to its increased transparency and market-based feedback. In fact, borrowers can engage in bilateral negotiations with single Lenders staying within the same Termgrid.

A mark-up/track changes mode ensures that both borrowers and lenders keep track of changes made during the entire negotiation and thereafter. The integrated excel export function enables borrowers to download a snapshot of the negotiation’s status for internal & external reporting purposes and, ultimately, share the final agreed Termgrid with the legal counsel for the drafting of the credit agreement & security documentation.

Conclusion

In summary, the Termgrid tool of Leverest is an essential tool for evaluating, negotiating and structuring (Leveraged) Debt Financing transactions combining established best-practices with the possibilities arising from digitalisation. It allows borrowers to create and share a range of possible financing structures and compare them quickly to identify the optimal financing structure. Ultimately, the Termgrid tool helps borrowers and lenders create a robust, flexible and sustainable financing structure that meets the requirements of all parties involved in the transaction.